04 November 2017

"Amazon is coming" - the phrase is being uttered across the nation in tones of impending doom reminescent of Game of Thrones' "Winter is Coming".

[UPDATE: Amazon officially launched in Australia on Tuesday 5 December 2017]

But do we really need to be afraid of Amazon?

Gartner VP, Miriam Burt, presenting at the 2017 Gartner Symposium in the Gold Coast, recommends less panic, more planning.

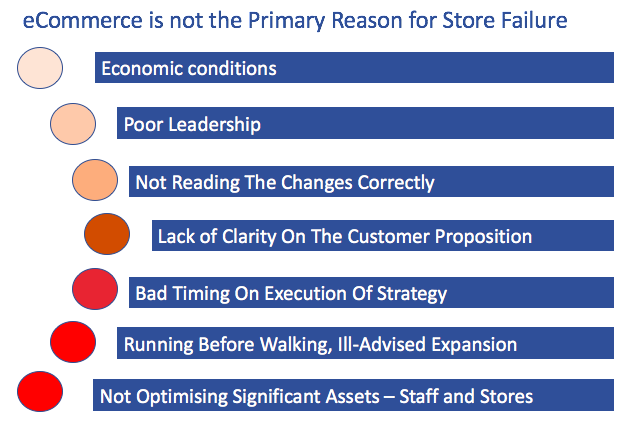

There is no doubt that across the globe - including in Australia - we have seen the recent failure of some high profile retail chains. But was Amazon to blame,. or was it a convenient scapegoat.

Many of the high profile collapses of store chains we have seen across the globe have had less to do with online competition and more to do with poor management, and other business issues, according to Burt.

Burt cites Australia's Dick Smith as an example. The electronics retailer shut the doors of 301 stores in mid-2015 with the loss of 3,000 jobs. In the hyperbole of "Amazon is coming", Dick Smith is often commonly thought of as the type of collapse we will see more of. But Dick Smith's collapse had nothing to do with the rise of online retailers.

"Dick Smith's collapse was due to the carrying of a massive inventory, ill-advised expanision and poor leadership, not as a result of online competition", says Burt.

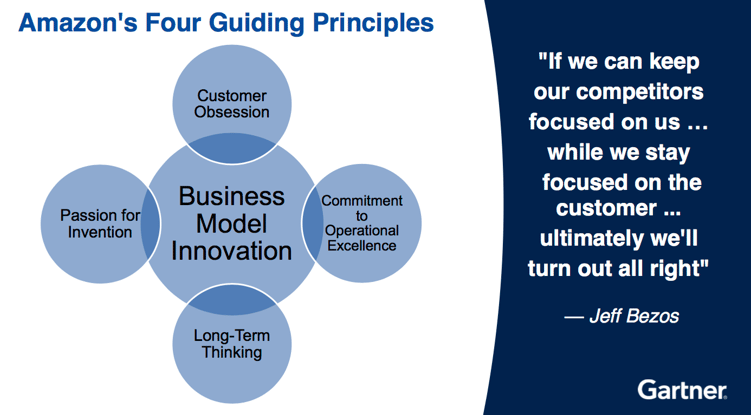

Rather than fearing Amazon, Australian retailers should learn from them, says Burt.

Amazon has a defined culture of Business Model Innovation. The company has four articulated guiding principles that have elevated its competitive positioning.

"In short", says Burt, "everything that Amazon innovates is designed to make the customer's lifestyle better, safer and simpler."

Australian retailers need to take their cue from this philosophy and apply it to their own operations.

In her presentation at the Gartner Symposium on the Gold Coast 30 Oct-2 Nov 2017, Miriam Burt, outlined a nine point plan of attack for Australian retailers facing the arrival of Amazon.

1. Excellent Mobile Experience (Instore and Out)

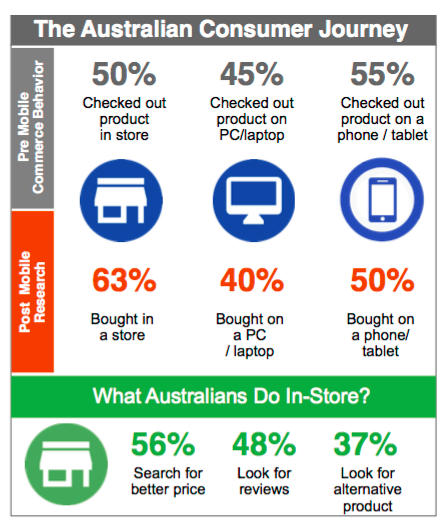

With the exception of books, music and video, all other retail sectors continue to be dominated by instore purchases. However, consumers - especially Generation Z - expect an integrated mobile experience instore.

In fact Australians are already using their mobile phones instore checking competitive prices, looking for reviews or tech specs; and looking for alternatives. Stores who embrace this behaviour and help shoppers will reap rewards.

There is a clear opportunity for the growth of "conversational commerce" instore using mobile messenger channels.

Credit: Miriam Burt "Going Nine Round with Amazon" Gartner Symposium 2017

2. Fullfilment Flexibility

Retailers with existing physical outlets need to utilise these for fulfillment flexibility. We have already seen the rise of 'Click and Collect' initiatives, as an alternative to courier delivery. However more innovation is needed. Why not get a headstart on Amazon Go (see video below) replicating this technology in existing stores? Other examples could include pop-up stores and flash sales with online promotion; and we have already seen the rise of UberEats and UberRush. Other flexible distribution channels are on the rise internationally.

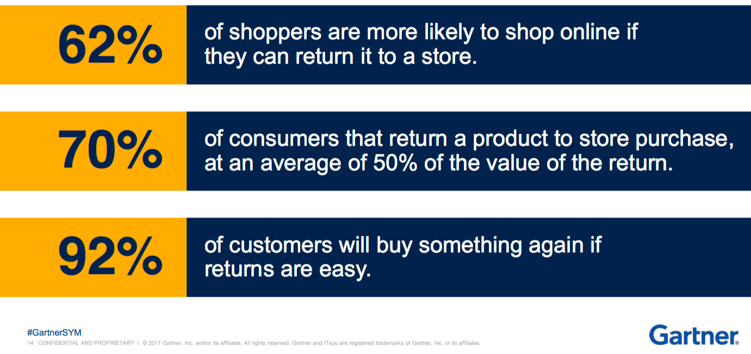

3. Ease of Returns

Delivery and returns are the two areas where Amazon have it all over exisitng retailers. Customers trust that they will get products delivered quickly and 'free of charge' from Amazon. They also trust that if the product is not what they expected for any reason, then it can be returned for a refund with ease. In fact many pundits describe Amazon as a "logistics company" first and foremost. Australian retailers need to rise to the challenge and rethink their attitude to customer returns.

4. Connect Beyond the Store

There are opportunities for manufacturers and retail groups to connect with existing customer touchpoints such as Google Home, Amazon Echo and other connected home and vehicle products. Examples could include adding to a list of groceries for a Coles or Woolworths online order, which could be delivered or collected instore.

5. Strong, enabled In-Store Workforce

This is perhaps the most undervalued asset of existing retailers, according to Burt. Happy staff equals happy instore customers. Research consistently places ''informed, available staff' in the top three of customer expectations when shopping instore. It is a competitive differentiator, yet many stores do not take advantage of it. In my local Bunnings store, the staff give me excellent, knowledgeable advice, find items on crowded shelves for me, and deliver free 'How To' workshops - not to mention the charity sausage sizzle. Giving staff the tools to do their job well is crucial in the battle against online.

6. Service-Led Retail

Strong enabled people leads directly into the competitive advantage of having a "service-led" sector. How can having a physical presence provide opportunity to enhance service? Examples include customised, personalised instore experiences such as:

7. AI Enabled

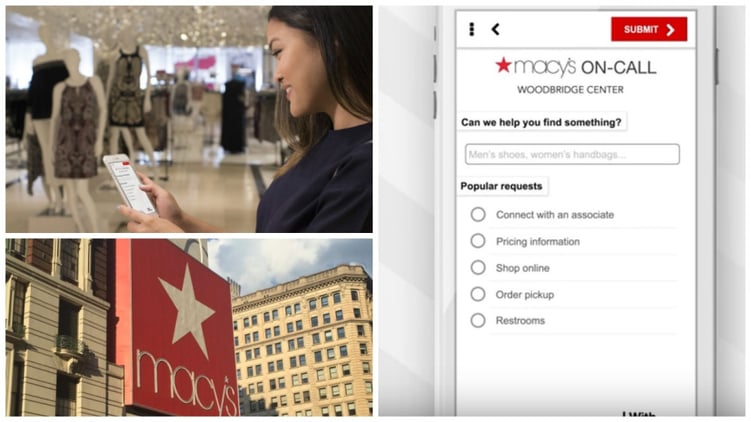

Existing retail outlets should utilise AI to enhance shoppers' instore experience. In the US, Macy's has collaborated with IBM Watson to develop a mobile AI shopping assistant. This is essentially an App helping customers find items, confirm what sizes are in stock, and identify items on special offer.

8. Collaboration

Australian retailers should seek out partners to collaborate with. For example in the UK, the grocery store Waitrose and the department store John Lewis are owned by the same group. Customers can nominate to collect from either outlet so groceries can be collected at John Lewis , and clothing or shoes can be collected at the supermarket. In fact so many clothing items were being collected at Waitrose, the supermarket chain added a fitting room to some stores.

9. Engaging Instore Experience

Stores need to be both an 'execution hub' and an 'experiential hub'.

Dubai Mall is the largest mall in the world and a true experience, where tourists go to soak up the style and sights of the mall - and also happen to do all their shopping. The mall has an indoor ice rink and ski field, an aquarium, indoor fun park complete with roller coaster, 3-storey waterfall, numerous sculptures and artworks, as well as amazing shopfront displays fro the world's leading brands.

Online monolith, Alibaba has recently opened a slew of stores in Chin,a with a new retail strategy to blend online and offline shopping. The Chinese giant focused on grocery, with 13 stores across Beijing and Shanghai. Research told them their target customers liked their grocery store to feel like a marketplace; and their favourite purchase is fresh seafood. Responding to this information, Alibaba incorporated huge vats of fish and crustaceans into the store design. There is a large 'wet market' and customers can hand select their purchases. Customers can shop, dine and order groceries for delivery from their mobile phones; and then use Alipay to make payments.

Alibaba uses big data analytics to remember purchase preferences for each customer and make personalized recommendations on the app. It also provides a data-driven selection of fresh food to customers based on their locations.

Australian retailers should learn from the likes of Alibaba and focus on making their stores more experiential. Supermarkets have started down this track, but other retail sectors are lagging behind. Give shoppers a reason to get off the couch and come into the store to browse and buy.

Credit: This blog is based on a presentation delivered by Gartner VP, Miriam Burt, at the Gartner Symposium, Gold Coast Australia, 30 October - 2 November 2017.

Related Blogs

3 Strategies to Reduce Telecom Cost